Introduction: Credit as Your Travel Passport

Imagine landing in Paris, sipping espresso on a balcony in Rome, or watching the sunrise over Machu Picchu — all made possible not just by wanderlust, but by the quiet power of good credit. If that sounds far-fetched, it’s not. Credit management for travel isn’t a finance-class-only secret. It’s one of the most effective tools for helping everyday travelers — families, solo explorers, and culture seekers alike — fund, enhance, and unlock their journeys.

In this guide, we’ll demystify credit management and show how travelers, especially U.S.-based readers, can turn smart credit use into unforgettable adventures. Whether you’re planning your first trip abroad, dreaming of a luxury honeymoon, or simply want to save money while traveling smarter, understanding how to improve your credit score can make the difference between a budget squeeze and a breeze.

From earning travel perks and slashing interest rates to getting approved for that dream apartment or vacation car rental, this is your go-to resource for using credit as a vehicle — literally and figuratively — to see more of the world.

Let’s dive into how managing your credit can help you travel farther, smarter, and with fewer financial headaches.

TL;DR (Too Long; Didn’t Read)

Strong credit can make travel easier, cheaper, and more rewarding — from unlocking premium travel perks to saving on flights, rentals, and even mortgages. This guide walks you through how credit scores work, what affects them, and how to build or rebuild yours step by step. You’ll also find traveler-specific strategies, credit myths to avoid, and the best tools to manage your score on the go. Whether you’re starting out or cleaning up your credit, this post gives you everything you need to travel smarter.

What Is Credit Management and Why It Matters for Travelers

At its core, credit management means keeping your borrowing habits healthy — paying your bills on time, avoiding excessive debt, and monitoring your credit history. It’s the financial foundation that helps lenders, landlords, and service providers decide how trustworthy you are when it comes to handling money.

For travelers, credit management isn’t just about numbers. It’s about freedom:

- The freedom to get approved for the best travel credit cards.

- The ability to book accommodations without massive deposits.

- The confidence to secure a rental car abroad or snag a deal on a last-minute flight.

Your credit profile affects real-world travel scenarios in ways that often go unnoticed — until they become roadblocks. Want to stay in that cozy vacation rental in London without a hefty deposit? Need to rent a van for your family road trip across the Southwest? Looking to apply for a home loan after returning from a year of digital nomad life? In every one of these situations, strong credit is your silent partner.

Good credit also means saving money — sometimes thousands — by unlocking better interest rates, higher credit limits, and more flexible repayment options. When every penny counts (especially for families or long-term travel planners), solid credit can make travel dreams not only possible but sustainable.

Understanding Credit Scores: The Basics You Can’t Skip

To manage credit well, you first need to understand the system that evaluates it. In the U.S., credit scores are three-digit numbers that represent your creditworthiness — basically, how likely you are to repay borrowed money.

What Is a Credit Score?

Credit scores generally range from 300 to 850, with higher numbers indicating stronger credit. There are two main scoring models in use:

- FICO® Score (used by most major lenders)

- VantageScore (used by some lenders and credit monitoring apps)

Each model uses similar criteria but may weigh them slightly differently. Scores are based on the information in your credit report — a detailed file that tracks how much you owe, whether you pay on time, and how long you’ve been using credit.

Who Reports and Who Cares?

There are three major credit bureaus in the U.S.:

These companies collect and maintain your credit information. Creditors — like banks, credit card issuers, and some landlords — report your activity to one, two, or all three bureaus.

Lenders check your report and score when you:

- Apply for a credit card

- Take out a loan

- Rent an apartment

- Set up utilities

- Even when renting a car or booking a travel-related service

For travelers, that means your credit score isn’t just relevant when financing big purchases — it can affect whether you’re able to travel freely without extra financial hurdles.

✨ Free travel toolbox

Free London map & travel toolkit

Grab a beautifully organized London travel map plus a mini bundle of planning resources to make future city trips feel calmer and more intentional.

- Key neighborhoods, highlights, and photo-friendly spots

- Simple tools for budgeting, bookings, and navigation

- Designed for busy, tech-savvy travelers and families

No spam, ever — just thoughtful travel emails and resources you can actually use.

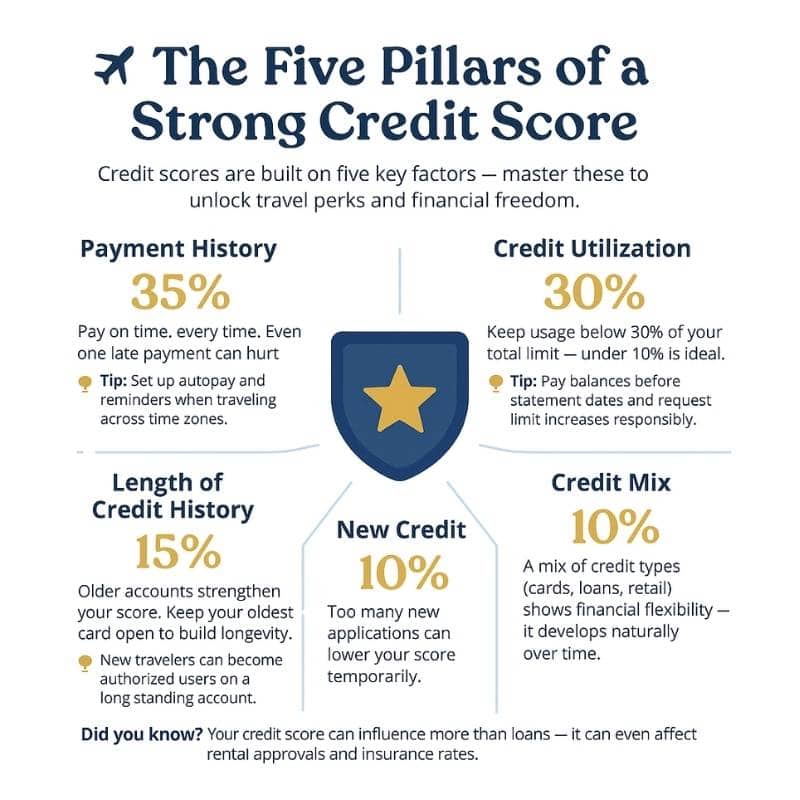

The Five Pillars of a Strong Credit Score

Credit scores are calculated using several key factors. Think of these as the “pillars” of your financial reputation. If you’re looking to build or boost your score — especially to qualify for top-tier travel perks or simplify your next trip — mastering these five categories is essential.

Payment History – Be On Time, Every Time

Weight: 35% of your score

This is the single most important factor. Lenders want to know: Do you pay your bills on time?

Late payments — even just one — can significantly lower your score. For travelers, this matters because missing a due date while abroad (or just distracted by trip planning) can derail your credit progress fast.

Pro Tip:

- Set up autopay for at least the minimum payment on every credit account.

- Use calendar reminders when traveling across time zones or on extended trips.

Why it matters for travelers: Many of the best travel credit cards — the ones that offer lounge access, free checked bags, or big points bonuses — require a strong history of on-time payments. If you’re aiming for those perks, start by never missing a due date.

Credit Utilization – The 30% Rule (and Why Lower Is Better)

Weight: 30% of your score

This refers to how much of your available credit you’re using — also known as your credit utilization ratio.

For example, if you have a $10,000 credit limit across all your cards and you’re carrying $3,000 in balances, your utilization is 30%. Ideally, you want to keep this ratio below 30% — and below 10% if you’re aiming for the highest scores.

For travelers:

A low utilization ratio not only boosts your score but also leaves you with more available credit for unexpected expenses on the road (like emergency flights or booking extra nights).

Quick wins:

- Pay down balances before statement dates (not just due dates).

- Ask your card issuer for a credit limit increase — as long as you don’t increase your spending.

Length of Credit History – Why Old Cards Matter

Weight: 15% of your score

Credit scoring models favor accounts with a long track record. The age of your oldest account, the average age of all accounts, and how recently each has been used all matter.

Don’t close your oldest card just because you don’t use it often.

Even if you prefer a newer travel rewards card, that older account helps anchor your score.

For travelers just starting out:

- Consider becoming an authorized user on a parent’s or partner’s long-standing credit card with a positive history.

New Credit – How Many Inquiries Is Too Many?

Weight: 10% of your score

Every time you apply for a new credit card or loan, a hard inquiry is added to your report. Too many hard inquiries in a short period may suggest financial instability or risk — which can lower your score temporarily.

Smart strategy for travelers:

Space out credit card applications and only apply for cards when you have a specific reason (like an upcoming trip where a travel bonus could help). Research pre-qualification options to check your chances without a hard pull.

Note: Checking your own score or using a free monitoring service? That’s a soft inquiry and does not impact your score.

Credit Mix – The Minor Player With Major Influence

Weight: 10% of your score

Having a mix of credit types — like credit cards, installment loans (student loans, car loans), and retail accounts — shows lenders you can handle different forms of debt.

But don’t go opening accounts just to “diversify.” This is the least important factor, and it will grow naturally over time.

How to Build or Rebuild Your Credit (Even From Scratch)

Whether you’re just starting your credit journey or bouncing back from past missteps, the road to a better credit score is absolutely navigable — and you don’t need to be a financial guru to get there. These practical, travel-friendly strategies will help you build or rebuild your credit foundation step by step.

How to Build or Rebuild Your Credit (Even From Scratch) by Elias JireisStart with Secured Credit Cards or Credit-Builder Loans

If you have little to no credit history — or a score that’s too low to qualify for traditional credit cards — consider beginning with:

- Secured Credit Cards: These require a refundable deposit (usually $200–$500), which acts as your credit limit. Use the card for small purchases (like groceries or gas), pay it off in full each month, and over time, the issuer will report your responsible behavior to the credit bureaus.

- Credit-Builder Loans: These work in reverse — you “borrow” a small amount (say, $500 to $1,000), which gets held in a savings account while you make monthly payments. Once repaid, the money is yours — and your on-time payments help establish a strong credit history.

Traveler’s Tip: Use your secured card for recurring travel-friendly purchases — like a subscription to a language-learning app or Airbnb gift cards — then pay it off monthly. This builds your credit and your travel readiness at the same time.

Become an Authorized User

This is one of the easiest and safest ways to build credit quickly — especially helpful for young adults, students, or partners just getting started.

Ask a family member or spouse with a well-established credit card to add you as an authorized user. If their account has:

- On-time payments

- A low balance relative to the limit

- A long account history

Then those positive factors can reflect on your credit report, boosting your score without you having to take on new debt or qualify for your own card right away.

Just ensure the primary cardholder is financially responsible. If they miss a payment, it could affect your score too.

Check Your Credit Reports for Errors (And Dispute Them)

Did you know that 1 in 3 Americans finds an error on their credit report? These can range from incorrect balances to outdated negative marks — and they can drag down your score without you even knowing it.

Here’s how to stay ahead:

- Visit AnnualCreditReport.com to get your free credit report from each of the three bureaus.

- Review each report thoroughly — look for old collections, unfamiliar accounts, or payment inaccuracies.

- Dispute any errors directly through the credit bureau’s website. They’re legally required to investigate and resolve it within 30 days.

Bonus Travel Insight: Fixing a reporting error can sometimes result in a quick and significant score increase — helping you qualify for that travel card you’ve had your eye on faster than expected.

Use Credit Monitoring Tools Wisely

Credit monitoring apps aren’t just for the credit-obsessed — they’re essential tools for tracking progress, protecting your identity, and catching dips in your score before they impact your travel plans.

Popular (and mostly free) options include:

- Credit Karma (TransUnion + Equifax VantageScores)

- Experian (with access to FICO Score)

- Mint or NerdWallet (good for financial snapshots + monitoring)

- Some travel-friendly credit cards also offer free FICO Score tracking as a perk

Set up alerts so you’re notified when:

- Your balance spikes

- A new account is opened in your name

- Your score changes by a significant number

This not only helps you stay in control but also gives you peace of mind when you’re hopping borders or living out of a suitcase.

Travel-Smart Credit Strategies for Every Budget

Credit isn’t just about managing debt or paying bills on time — it’s a powerful asset for travelers. When handled wisely, it can cut travel costs, unlock luxury perks, and make the whole experience smoother from start to finish.

Let’s look at how to use your credit to support your travel lifestyle without taking on financial stress.

Why Travelers Need Great Credit (and How It Pays Off)

Strong credit isn’t just about borrowing money — it opens doors while you’re exploring the world. Some direct benefits include:

- Easier approvals for vacation rentals, hotels, or long-term stays

- Lower deposits on rental cars or accommodations

- Faster application approvals for travel-related services

- Better currency conversion options with top-tier travel cards

- More flexible booking options during peak seasons or emergencies

If you’ve ever been denied a rental because you didn’t have a “real” credit card — or had to cough up a large deposit before checking into your Airbnb — you’ve already experienced the gatekeeping power of credit. Getting your score up can mean never facing that situation again.

Smart Use of Travel Credit Cards

Travel credit cards are like power tools — incredibly effective when used properly, and potentially risky if mismanaged. The secret? Use them for what they’re designed for: earning rewards, gaining protections, and leveraging perks, not carrying balances.

Here’s how to make them work for you:

- Use them for regular expenses (groceries, gas, subscriptions), not random splurges.

- Pay your balance in full each month — interest cancels out rewards.

- Focus on cards that align with your travel habits (airline-specific, hotel chains, or general-purpose like Capital One or Chase travel cards).

- Take advantage of introductory bonuses, but don’t open too many at once (avoid hard inquiry overload).

- Always set up autopay — a late payment can not only damage your score but cause you to forfeit those juicy travel rewards.

Real Talk: That 60,000-point bonus for spending $4,000 in 3 months can literally cover an international flight — but only if you don’t rack up debt chasing it. Spend intentionally, not impulsively.

✈️ Which Type of Travel Credit Card Is Right for You?

Improving your credit opens the door to travel cards that reward you for every mile, night, and adventure. Here’s a quick look at the most common types — so you can find one that fits your travel style:

- Flexible Points Cards: Earn points that can be redeemed across airlines, hotels, and travel portals. Great for travelers who value choice and flexibility.

- Airline Co-Branded Cards: Ideal for loyal flyers — these often come with perks like free checked bags, priority boarding, and companion passes.

- Hotel Credit Cards: Perfect for frequent stays, offering upgrades, late checkouts, and free night certificates.

- No-Foreign-Transaction-Fee Cards: Essential for international travel, helping you avoid that pesky 3% fee on every purchase abroad.

- Flat-Rate Travel Cash Back Cards: A simple option that lets you earn travel credit or statement rewards without tracking bonus categories.

🌍 Choose based on how you travel — and let your credit card work for your next adventure.

Protecting Credit While Abroad

Worried that managing your credit is harder when you’re overseas or living a nomadic lifestyle? It doesn’t have to be.

Here’s how to keep your score intact while globe-trotting:

- Set up paperless billing and account alerts so you never miss a due date.

- Use credit cards with no foreign transaction fees — these not only save you ~3% on every purchase abroad but also tend to offer solid protections and rewards.

- Freeze your credit reports temporarily when traveling long-term to avoid identity theft (can be easily lifted when needed).

- If you won’t use certain cards abroad, keep them open with minimal activity (use once every 3–6 months to prevent closure for inactivity).

- Avoid using BNPL or sketchy lenders abroad — stick with your reliable U.S. cards and monitor activity through a secure VPN when accessing financial apps.

Gaia Gazer Tip: Make a pre-departure checklist that includes credit monitoring and payment automation — just like you’d prep your passport or pack your chargers. It’s a simple habit that keeps your financial life stable no matter where your feet land.

✈️ Ready to Put Your Travel-Ready Credit to Use?

Now that your credit is in great shape, let’s turn your travel goals into a real adventure. Whether you’re dreaming of a family-friendly escape, cultural immersion, or a weekend getaway, our free AI-powered itinerary builder creates a personalized, day-by-day travel plan just for you.

✨ Zero stress. 100% custom. Your next unforgettable trip starts here:

Leveraging Credit for Bigger Life Goals (Beyond Travel)

While this guide focuses on travel, smart credit management benefits go way beyond airport lounges and vacation rentals. Whether you’re saving for a home base between trips, financing a family car for road trips, or planning to lease an apartment in a new city, credit is your quiet enabler.

Buying a Home or RV: Why Credit Is Your Leverage

If you’re dreaming of buying a home — whether it’s a cozy starter or a custom-built travel hub on wheels — your credit score will directly affect:

- Whether you qualify for a mortgage or vehicle loan

- Your interest rate (the difference between a 4% and 7% rate on a 30-year mortgage = tens of thousands of dollars)

- Your required down payment

- Your ability to refinance later for better terms

Even if homeownership isn’t your immediate goal, working on your score now makes that dream smoother and more affordable when the time comes.

Auto Loans for Road Trip Vehicles – Rates and Scores Matter

For families or cultural explorers who love the open road, your car loan interest rate can be drastically better with good credit.

Consider this:

- A borrower with a 760+ credit score might get a car loan at ~5.2%

- A borrower with a sub-600 score could be paying over 15%

That’s a $100+ difference in monthly payments for the same car. Money better spent on gas, snacks, and national park passes, right?

Rental Applications Abroad and Stateside – Credit as Proof of Reliability

Landlords (and even Airbnb hosts for long-term stays) may review your credit or ask for financial references. With strong credit, you:

- May skip hefty security deposits

- Can rent better properties in safer areas

- Increase your chances of getting approved when inventory is limited

Travelers who plan to live abroad, apply for visas, or rent short-term accommodations benefit tremendously from having a clear, clean credit file. It shows you’re responsible — even across borders.

Common Credit Myths Travelers Still Believe

When it comes to credit, misinformation spreads faster than a budget airline sale. Travelers — especially those juggling foreign transactions, multiple cards, and long travel timelines — are particularly vulnerable to believing advice that sounds helpful but can backfire. Let’s bust some of the most common myths still floating around in the travel community.

“Carrying a Balance Improves Your Score”

This is one of the most stubborn myths — and one that costs people real money.

The truth: You do not need to carry a balance to build credit. In fact, carrying a balance month-to-month only leads to interest charges, which can erode your finances quickly — especially on high-interest travel credit cards.

✅ Instead: Use your card regularly, keep your utilization low (ideally under 30%, or even better, under 10%), and pay off your full balance by the due date each month.

“Checking My Own Credit Will Hurt My Score”

Nope. This is a soft inquiry and has zero impact on your credit.

You can (and should) check your score regularly via free monitoring tools or directly from your credit card issuer. Staying informed helps you respond quickly to changes — especially important while traveling when fraudulent charges can sneak in unnoticed.

✅ Use apps like Credit Karma, Experian, or even your bank’s credit tracking service to monitor progress safely and often.

“Closing Unused Cards Helps My Credit”

Unless the card has high annual fees or poses a security risk, closing old accounts usually hurts your score more than it helps.

Why? Because:

- It reduces your overall credit limit (hurting your utilization ratio).

- It can lower your average account age (which hurts your score’s “length of credit history” factor).

✅ If you’re not using a card, consider sock-drawing it — keep it open, charge a small subscription to it (like Spotify or cloud storage), and automate the payment.

“Using Buy Now, Pay Later (BNPL) Builds Credit”

Most BNPL services (like Klarna, Afterpay, or Affirm) do not report your payments to credit bureaus unless you miss a payment or enter collections. That means responsible use of BNPL won’t help your credit score — but misuse can definitely hurt it.

✅ If your goal is to build or rebuild credit, stick with traditional tools: secured credit cards, authorized user status, or credit-builder loans.

“I’ll Never Recover from Bad Credit”

Here’s the hopeful truth: Credit is resilient. Negative items like late payments, collections, or even bankruptcy don’t last forever. Most fall off your report after 7 years — and positive behavior has ongoing impact.

You can:

- Start building positive history now, even if your score is low.

- Dispute inaccurate negatives.

- Watch your score recover with consistent payments and low utilization.

✅ Travelers returning from rough financial years (or recovering from past credit misuse) can absolutely bounce back — often faster than expected.

Top Tools and Resources to Help Manage Credit Like a Pro

Smart travelers don’t just pack well — they prepare financially, too. Credit management becomes far easier (and less stressful) when you have the right tools and resources by your side. From monitoring apps to official government portals, these solutions help you stay on top of your credit game — wherever you roam.

AnnualCreditReport.com – Your Free Credit Snapshot

This is the only federally authorized source where U.S. consumers can request free annual credit reports from all three major bureaus: Equifax, Experian, and TransUnion.

- Normally, you get one free report from each bureau every 12 months.

- As of recent updates, free weekly reports may still be available — check for current extensions.

✅ Why it matters for travelers: Schedule a credit check before long trips to ensure your identity is secure and your accounts are in good standing.

📌 Website: AnnualCreditReport.com

Credit Monitoring Apps and Simulators

If you’re working toward a higher score, real-time insights and alerts can keep you on track. These apps help you monitor your score, track utilization, and even simulate how different actions (like paying down debt or opening a new card) might affect your credit.

Popular Free Options:

- Credit Karma (TransUnion + Equifax, VantageScore)

- Experian (Offers access to your real FICO Score)

- Credit Sesame

- Mint or NerdWallet (for credit + budgeting overview)

✅ Tip: Turn on push notifications for score changes, new inquiries, or unusual activity — especially important when you’re traveling and less likely to catch issues manually.

Educational Resources to Deepen Your Understanding

Want to master credit like a seasoned pro? There’s no shortage of free, trusted education out there.

- Consumer Financial Protection Bureau (CFPB): Offers clear, up-to-date guides on understanding credit scores, resolving disputes, and protecting your credit while traveling.

- NerdWallet, Bankrate, and Experian’s blogs: Provide helpful comparisons, beginner guides, and updated tips on using credit cards, loans, and travel financing wisely.

✅ Great for self-paced learners or those preparing for large purchases like homes, cars, or extended travel.

Credit Freezes and Fraud Alerts – Peace of Mind for Travelers

Traveling for extended periods? Minimize your identity theft risk:

- Credit Freeze: Blocks new creditors from accessing your credit file until you unfreeze it. Ideal when you’re not applying for new credit any time soon.

- Fraud Alert: Warns creditors to verify your identity before opening new accounts.

✅ Best for long-term or international travel. Free to set up and manage online through each bureau’s portal.

Credit Counseling (Nonprofit)

Sometimes, a little human guidance makes all the difference. If you’re overwhelmed, uncertain, or recovering from past credit damage, consider speaking with a certified counselor.

Look for organizations affiliated with:

They can help you:

- Review your reports

- Build a personalized credit action plan

- Possibly negotiate repayment strategies with lenders

✅ Why it matters: Travel can be healing, but if financial stress is holding you back, a clean plan and peace of mind can help you move forward — mentally and financially.

🗺️Interactive travel maps

See Your Trip Come Alive on the Map

A peek at how GaiaGazer’s curated travel maps look right inside your Google Maps app—ready to guide you through each city.

1 / 4

Conclusion: A Well-Traveled Life Starts With a Well-Managed Credit

Whether your goal is sipping espresso in Florence, road-tripping through the Rockies with your kids, or applying for a mortgage between adventures, your credit profile plays a key role in your journey.

And here’s the good news: Credit doesn’t require perfection — it requires attention.

With the right strategies — paying on time, managing balances, using travel credit cards wisely, and avoiding common pitfalls — you can build a credit foundation that supports your lifestyle, both on the road and at home.

Managing your credit is like packing the perfect carry-on: it takes some thought upfront, but it makes the entire trip smoother, lighter, and way more enjoyable.

So, before your next adventure, ask yourself: Is my credit travel-ready?

If not, now you know where to begin. And if yes — congratulations, you’re already miles ahead.

Let your credit score be your passport to a freer, more flexible, and better-traveled life.

✈️💳 Here’s to smarter journeys and stronger credit. You’ve got this.

Your Ultimate Travel Companion

Frequently Asked Questions About Credit Management for Travel

Q: How long does it take to improve your credit score for travel rewards cards?

A: It typically takes 3 to 6 months of consistent on-time payments and reduced credit utilization to see noticeable improvements in your credit score. However, building or rebuilding strong credit can take longer depending on your starting point and past credit history.

Q: What credit score do you need to qualify for travel credit cards?

A: Most travel rewards credit cards require a good to excellent credit score, usually 670 or higher. Premium cards with larger bonuses or perks often require scores above 720. Some cards for fair credit exist but may offer fewer travel benefits.

Q: Will checking my credit score while traveling hurt my credit?

A: No, checking your own credit score is a soft inquiry and does not affect your score. It’s recommended to monitor your credit regularly, especially while traveling, to track progress and detect any suspicious activity.

Q: Can I build credit if I don’t have a credit card?

A: Yes. You can build credit using tools like credit-builder loans, becoming an authorized user on someone else’s credit card, or using rent and utility reporting services. However, responsible credit card use remains one of the fastest ways to build credit.

Q: Should I close old credit cards I don’t use before applying for new travel cards?

A: Generally, no. Closing older accounts can reduce your overall available credit and shorten your credit history, both of which may negatively affect your score. If the card has no annual fee, consider keeping it open with occasional small purchases.

Q: What happens to my credit score if I travel long-term and stop using my cards?

A: Inactivity can lead to credit card issuers closing your account, which may lower your credit score. To avoid this, use each card at least once every few months and set up automated payments to maintain activity without effort.

Q: Do buy now, pay later (BNPL) services help me build credit for travel?

A: Most BNPL services do not report on-time payments to credit bureaus, so they typically don’t help build credit. Missed payments, however, may be reported and could hurt your score. For credit-building purposes, traditional tools are more reliable.

Q: Can good credit help with travel-related rentals and bookings?

A: Yes. A strong credit score can make it easier to rent cars, book accommodations without large deposits, and qualify for better travel-related financing options. It may also reduce the likelihood of additional screening or financial hurdles during your trip.

📌 Love cultural travel? Explore more ideas on Pinterest →

Comments